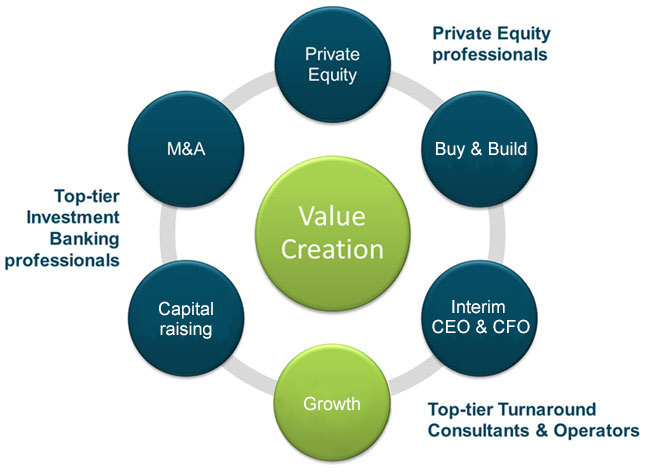

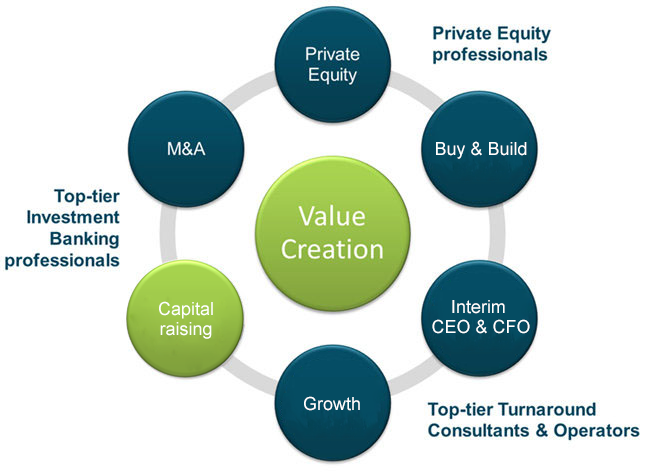

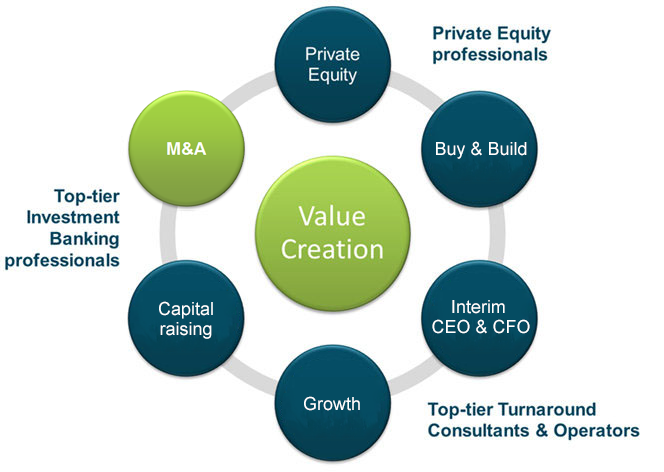

Our mission

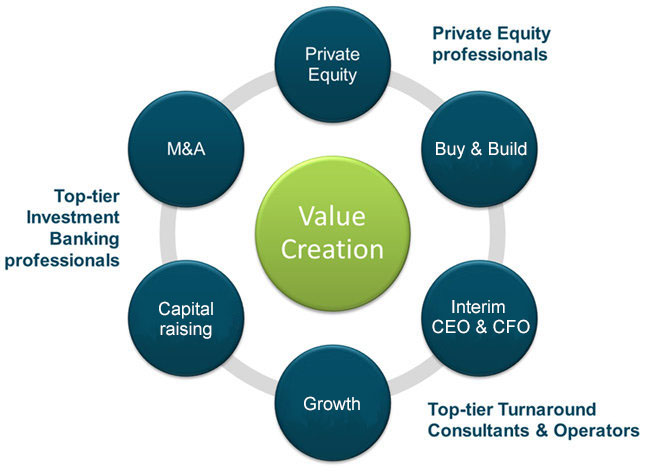

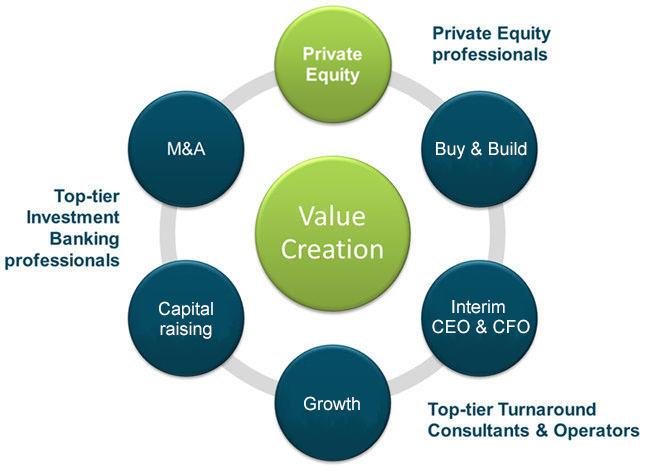

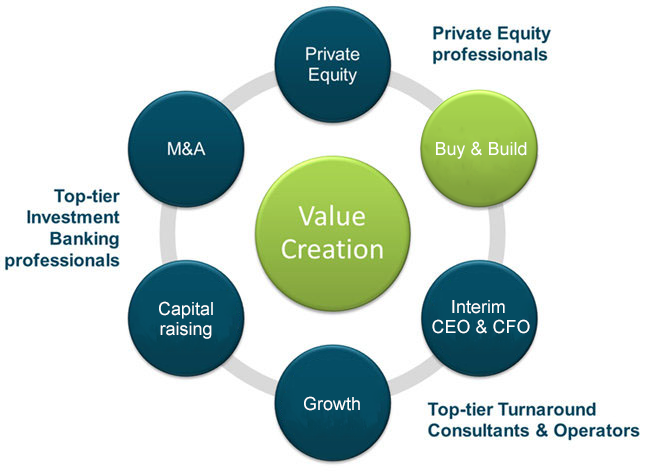

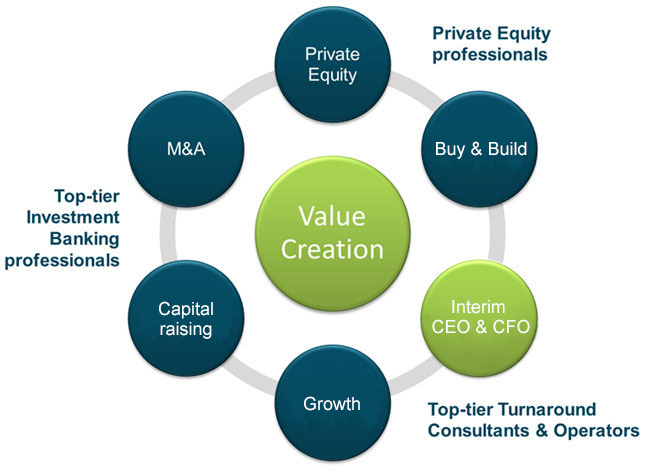

It is our mission to be unequivocally focused on maximizing value of our clients, both by preserving value where it is at risk and by delivering the full potential of expansion. In order to do so, we align our interests to those of our clients.

Our expertise

Our services

Stijn Proost

Prior to founding Proost Ventures, Stijn worked as Investment Director at AnaCap Financial Partners, a London-based specialist Private Equity Fund focused on investments in the EU Financial Services sector. At AnaCap, Stijn led several transactions, including the first-ever acquisition of a retail bank by a Private Equity Fund in the UK (Aldermore Bank). Prior to AnaCap, he worked as Senior Associate in the Investment Banking Division of Goldman Sachs in London as part of the FIG-team. Stijn started his career as a Management Consultant at Bain & Company.

Stijn holds a Master in Commercial Engineering (Magna Cum Laude) from the Katholieke Universiteit Leuven (KUL) with a concentration in Finance, as well as an MBA (Magna Cum Laude) from The University of Chicago Booth School of Business with a concentration in Finance and Entrepreneurship.

Stijn is an Honorary Fellow from the Belgian-American Educational Foundation (BAEF), an Ambassadorial Scholar from The Rotary Foundation, and was invited to become a Fulbright Scholar

Knowledge + Experience = Power

“In a knowledge-based and digital society, success in business is driven by having accurate, up-to-date, and relevant knowledge at your fingertips, combined with experience. Proost Ventures is the source for success through knowledge and experience. We strive to be the best, not necessarily to be the largest at the expense of quality.”

Founder experience

-

2000-2005

Bain & Company

Consultant

Stijn started his career as a Management Consultant at Bain & Company Benelux, working amongst others on private equity due diligence assignments, cost effectiveness programs, and M&A transactions.

2005

The University of Chicago Booth School of Business

Master in Business Administration (MBA)

To further build international business experience, Stijn pursued an MBA (Magna Cum Laude) from The University of Chicago Booth School of Business with a concentration in Finance and Entrepreneurship. During the application process, Stijn obtained a number of Fellowships: Honorary Fellow from the Belgian-American Educational Foundation (BAEF), Ambassadorial Scholar from The Rotary Foundation, and an invitation to become a Fulbright Scholar.

-

2006-2008

Goldman Sachs (UK)

Senior Associate

Stijn worked as Senior Associate in the Investment Banking Division of Goldman Sachs in London as part of the FIG-team (Financial Institutions Group), with a particular focus on Benelux banks and insurance M&A.

2008-2010

AnaCap Financial Partners (UK)

Investment Director

Prior to founding Proost Ventures, Stijn worked as Investment Director at AnaCap Financial Partners, a London-based specialist Private Equity Fund focused on investments in the EU Financial Services sector. At AnaCap, Stijn led several transactions, including the first-ever acquisition of a retail bank by a Private Equity Fund in the UK (Aldermore Bank), a landmark transaction.

-

2010 - Present

Proost Ventures

Managing Director & Founder

Stijn decided to found Proost Ventures as an advisory boutique for strategic issues focusing on Private Equity, Strategy, and Corporate Finance. Since 2010, Proost Ventures has completed in excess of 30 client engagements with clients including Private Equity funds (both mid-cap and global top-10 funds), their portfolio companies, and (divisions of) private companies.

2016

Vlerick Business School

Master in Interim Management

Proost Ventures creates value not only through advice, but also in turning advice into action. Stijn had already taken up longer-term assignments as Interim Manager within client companies to drive change. To further build Proost Ventures as a label of certified quality, Stijn pursued a Master in Interim Management at Vlerick Business School.