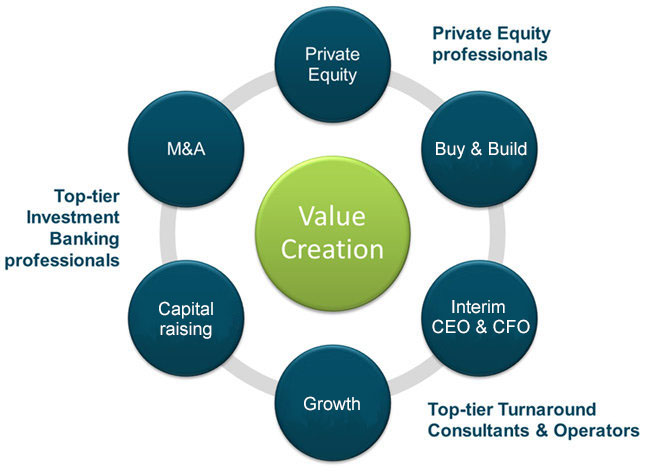

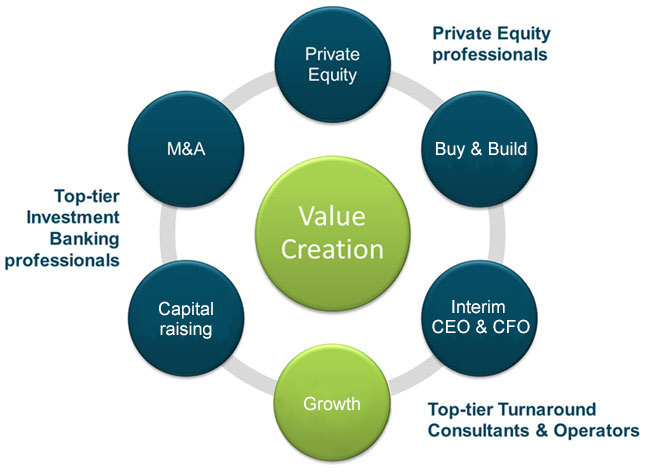

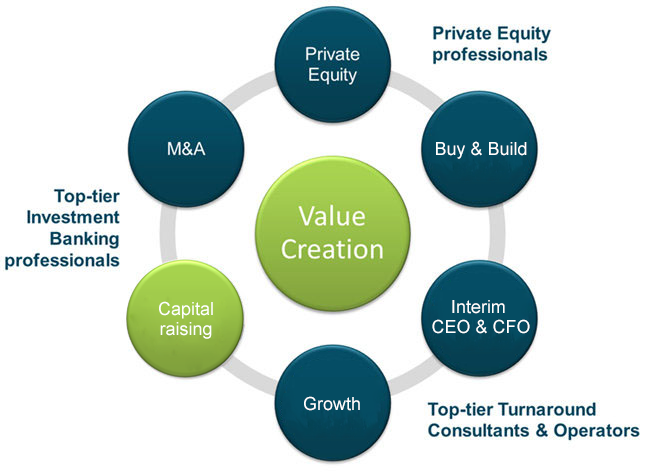

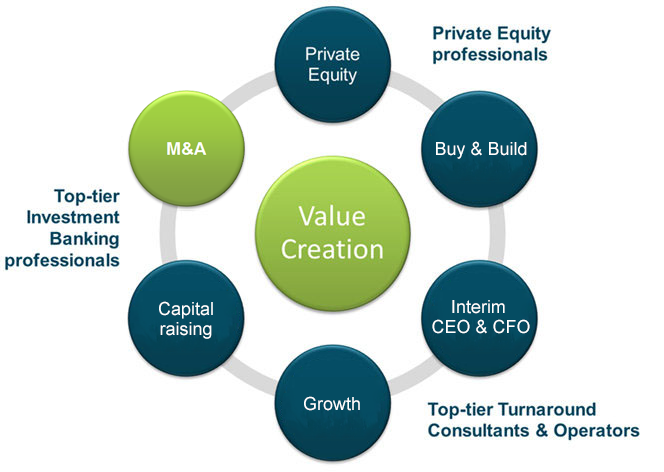

Our services

Private Equity

"Where is the value” requires “Think like an owner"

- Deal-phase: advise to structure, negotiate and close complex transactions

- Post – deal: full-potential / turnaround program

Buy-and-Build

“Enhance the value, one acquisition at a time”

- Accelerate profitable growth via serial acquisitions

- Sourcing, financing, add-on, and integration expertise

- Create a repeatable model

Interim-CEO and CFO

“Execute and deliver the value creation”

- Deliver strategic plan, especially in Buy-and-Build supported by Private Equity and Growth situations

- Temporarily fill in Senior Management roles of CEO and CFO

Growth

“Smart growth via top-line acceleration, margin expansion, and exit multiple growth"

- Improve top-line revenue growth

- Expand margins: Keep in mind simplified business model and embrace digital

- Generate momentum to achieve high exit-multiple

Capital raising

“Strategic capital to grow or re-position”

- Private placements

- Strategic long-term capital

- Spin-offs and demergers

- Crafting the equity story

M&A

“M&A to re-position strategy, not an objective itself”

- Growth: accelerate growth inorganically

- Full potential: Portfolio optimisation may require acquisition / disposal in certain segments

- Turnarounds: Disposals to generate capital